In the exciting world of finance, the future holds a revolutionary form of investment: cryptocurrency. This innovative digital currency has taken the world by storm, and understanding its potential is crucial. Welcome to “The Future of Finance: Cryptocurrency Investment Strategies.”

You may be wondering, what exactly is cryptocurrency and why should I care about it? Well, to put it simply, cryptocurrency is a virtual currency that uses cryptography for secure transactions. It operates independently of any central authority, like a government or a bank, making it decentralized and empowering individuals like you to take control of your financial future.

But why should you consider investing in cryptocurrency? The answer lies in the incredible opportunities it presents. Cryptocurrencies like Bitcoin and Ethereum have shown tremendous growth and potential for high returns. By understanding the strategies and techniques behind cryptocurrency investments, you can position yourself to ride the wave of the future.

So, if you’re ready to navigate the exciting world of cryptocurrency investment, join us as we explore the strategies, tips, and tricks that will help you make informed decisions and seize opportunities in this rapidly evolving market. Get ready to unlock the secrets of cryptocurrency investment and embark on an exciting journey into the future of finance!

The Future of Finance: Cryptocurrency Investment Strategies

Welcome to the exciting world of cryptocurrency investment strategies, where traditional finance meets cutting-edge technology. In this article, we will explore the future of finance as it relates to cryptocurrencies and delve into effective investment strategies to navigate this rapidly evolving landscape. Whether you are a seasoned investor or someone who wants to dip their toes into the world of cryptocurrency, this guide will provide you with the knowledge and tools to make informed investment decisions.

The Rise of Cryptocurrencies and Their Impact on Finance

The emergence of cryptocurrencies, led by Bitcoin, has sparked a revolution in the world of finance. Cryptocurrencies utilize blockchain technology, a decentralized and transparent system that eliminates the need for intermediaries such as banks. This disruptive technology has the potential to revolutionize finance by creating more inclusive, efficient, and secure financial systems.

As cryptocurrencies gain widespread adoption, they are challenging traditional financial institutions and payment systems. Cryptocurrencies offer benefits such as faster and cheaper transactions, borderless transfers, enhanced security, and financial sovereignty. Governments and corporations are also taking notice, with some central banks even exploring the possibility of issuing their own digital currencies.

However, with great opportunities come significant risks. The volatility of cryptocurrencies, regulatory uncertainty, and the potential for fraud and hacking highlight the need for investors to be well-informed and strategic in their approach to cryptocurrency investments.

1. Understanding the Different Types of Cryptocurrencies

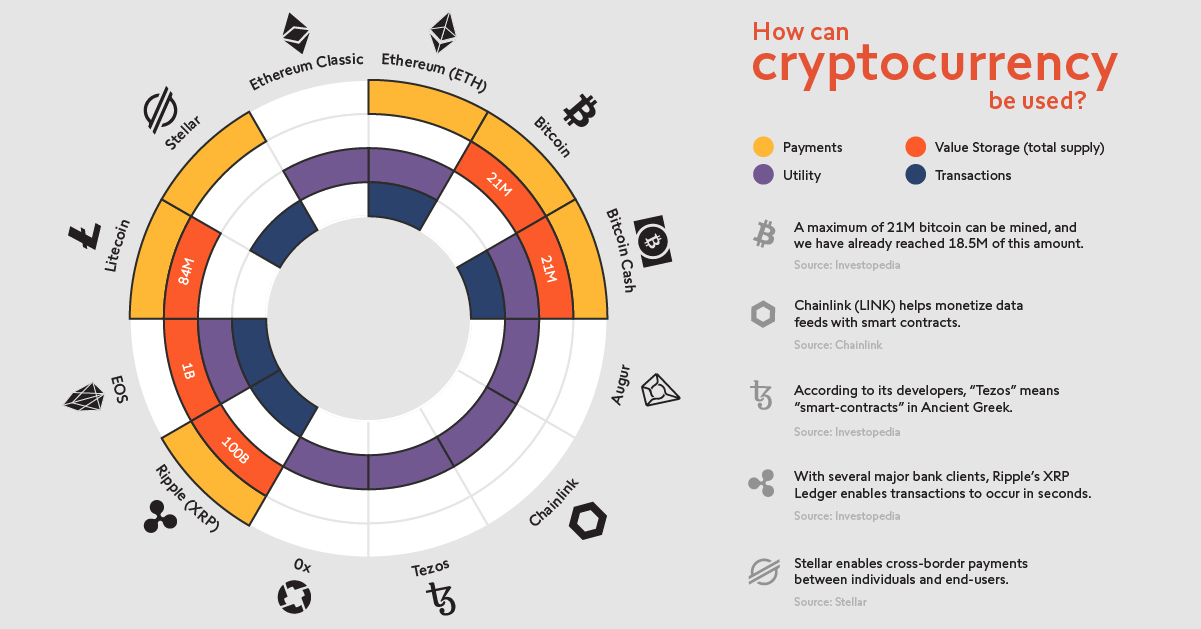

In order to effectively invest in cryptocurrencies, it is crucial to understand the different types that exist. While Bitcoin is the most well-known cryptocurrency, there are thousands of alternative coins, or “altcoins,” each with its own unique features and use cases.

Some altcoins aim to improve upon the limitations of Bitcoin, such as scalability and transaction speed, while others focus on specific industries or applications. By conducting thorough research and due diligence, investors can identify cryptocurrencies that align with their investment goals and risk tolerance.

It is also important to differentiate between cryptocurrencies and tokens. While both are digital assets, tokens typically represent ownership in a specific project or platform, whereas cryptocurrencies are meant to function as a medium of exchange or store of value.

1.1 Bitcoin: The Pioneer Cryptocurrency

Bitcoin, created by the mysterious Satoshi Nakamoto in 2009, paved the way for the entire cryptocurrency industry. It is a decentralized digital currency that operates on a peer-to-peer network, allowing for secure and transparent transactions without the need for intermediaries.

Bitcoin has gained mainstream recognition and acceptance, making it an attractive investment option for many. However, its high price volatility and slower transaction times have led to the development of alternative cryptocurrencies that aim to address these shortcomings.

Investing in Bitcoin requires careful consideration of its price trends, market sentiment, and regulatory developments. As the flagship cryptocurrency, Bitcoin often sets the tone for the broader cryptocurrency market.

1.2 Ethereum: Beyond Digital Currency

Ethereum is more than just a digital currency; it is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). The native cryptocurrency of the Ethereum network is called Ether (ETH).

Ethereum’s innovative capabilities have contributed to its success and made it the second-largest cryptocurrency by market capitalization. It offers programmability and flexibility that go beyond the scope of Bitcoin, allowing for the creation of decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and more.

Investors interested in Ethereum should consider factors such as its use cases, network activity, and the progress of its ongoing upgrade called Ethereum 2.0. Understanding the potential of Ethereum’s ecosystem can help identify investment opportunities within this dynamic market.

2. Developing a Cryptocurrency Investment Strategy

Successful cryptocurrency investing requires a well-thought-out strategy tailored to your individual goals, risk appetite, and time frame. Below are some key considerations to keep in mind when formulating your investment strategy:

2.1 Set Clear Investment Goals

Before diving into cryptocurrency investments, it is important to set clear goals. Are you looking for short-term gains or long-term wealth accumulation? Do you want to invest in established cryptocurrencies or take a risk on emerging projects? Defining your investment goals will help inform your decision-making process.

Keep in mind that the cryptocurrency market is highly volatile, and prices can fluctuate significantly in short periods of time. Setting realistic and achievable goals will help you stay focused and avoid making impulsive investment decisions.

2.2 Diversify Your Portfolio

Diversification is a fundamental principle of investment that applies to cryptocurrencies as well. By spreading your investments across different cryptocurrencies, you can mitigate the risk associated with any single asset.

Consider diversifying across different types of cryptocurrencies, such as established coins like Bitcoin and Ethereum, promising altcoins, and even tokens of promising platforms. Diversification can help capture potential gains while minimizing the impact of any individual investment not performing as expected.

2.3 Stay Informed and Conduct Due Diligence

In the rapidly evolving world of cryptocurrencies, staying informed is crucial. Follow reputable news sources, subscribe to industry newsletters, and join cryptocurrency communities to gain insights into market trends, regulatory developments, and technological advancements.

Additionally, conduct thorough due diligence before making any investment decisions. Research the team behind a cryptocurrency or project, examine their roadmap and progress, and evaluate the potential for adoption and long-term sustainability.

Being well-informed and conducting due diligence will help you make informed investment decisions and minimize the risks associated with cryptocurrency investments.

The Future of Cryptocurrency Investments: Trends and Predictions

As cryptocurrencies continue to gain traction and become an integral part of the financial landscape, it is important to explore the future trends and potential opportunities in this space. Here are three key areas to watch:

1. Institutional Adoption and Regulatory Clarity

Institutional adoption of cryptocurrencies is expected to increase as more traditional financial institutions recognize their potential. Large investment firms, banks, and hedge funds are entering the cryptocurrency market, providing validation and liquidity.

Regulatory clarity is also crucial for the widespread adoption of cryptocurrencies. As governments develop regulations to address security, investor protection, and anti-money laundering concerns, it is likely that the cryptocurrency market will become more transparent and accessible to retail investors.

2. Decentralized Finance (DeFi) and the Rise of Digital Assets

Decentralized Finance (DeFi) is an exciting area within the cryptocurrency ecosystem that aims to recreate traditional financial systems using blockchain technology. DeFi applications offer services such as lending, borrowing, staking, and yield farming, all without the need for intermediaries.

The growth of DeFi has been exponential, with billions of dollars locked in smart contracts. This innovative sector is likely to disrupt traditional financial intermediaries and reshape the way we borrow, lend, and invest.

Additionally, the rise of digital assets extends beyond traditional cryptocurrencies. Non-fungible tokens (NFTs), which represent ownership of unique digital assets such as artwork and collectibles, have gained significant attention and value. Exploring emerging trends and opportunities in the realm of digital assets can lead to exciting investment prospects.

3. Developments in Blockchain Technology

Blockchain technology is not limited to cryptocurrencies; its potential applications extend to various industries such as supply chain management, healthcare, and voting systems. As blockchain technology evolves, investments in companies that harness this technology are likely to benefit.

Keep an eye on developments such as scalability solutions, interoperability between different blockchains, and the integration of privacy features. Understanding and investing in the underlying technology behind cryptocurrencies can provide exposure to potentially transformative innovations.

In conclusion, the future of finance is undoubtedly intertwined with cryptocurrencies. As the world becomes more digitized and traditional financial systems face challenges, cryptocurrencies offer a new paradigm of financial inclusion and innovation.

However, it is crucial to approach cryptocurrency investments with caution, as the market is still relatively young and volatile. By understanding the different types of cryptocurrencies, developing a well-thought-out investment strategy, and staying informed about the latest trends and developments, investors can navigate the dynamic world of cryptocurrency investments with confidence.

The Future of Finance: Cryptocurrency Investment Strategies

When it comes to investing in cryptocurrencies, here are the key takeaways to keep in mind:

- Diversify your cryptocurrency portfolio to spread the risk.

- Stay updated with the latest news and trends in the cryptocurrency market.

- Research and understand the fundamentals and technology behind each cryptocurrency before investing.

- Consider the potential risks and volatility associated with cryptocurrency investments.

- Have a long-term investment mindset to navigate through market fluctuations.

Frequently Asked Questions

Cryptocurrency investment strategies have gained popularity as the future of finance. Below, we answer some common questions about this growing field.

1. Why should I consider investing in cryptocurrency?

Investing in cryptocurrency offers several advantages. First and foremost, it provides an opportunity to be part of a revolutionary technology that has the potential to disrupt traditional financial systems. Additionally, the decentralized nature of cryptocurrencies can offer protection against inflation and government interference. Moreover, the high volatility of cryptocurrencies presents opportunities for significant returns on investment. However, it’s important to note that cryptocurrency investments also come with risks, so thorough research and understanding are crucial.

2. How can I choose the right cryptocurrency to invest in?

Choosing the right cryptocurrency to invest in requires research and analysis. Start by understanding the purpose and underlying technology of the cryptocurrency. Look for projects that have a strong development team, clear roadmap, and a solid use case. It’s important to assess the market demand and potential for adoption. Consider factors such as community support, liquidity, and the credibility of the project. Diversifying your portfolio with a mix of established cryptocurrencies and promising altcoins can also mitigate risks and maximize potential gains.

3. What are the different investment strategies for cryptocurrencies?

There are several investment strategies to consider when investing in cryptocurrencies. One common approach is “HODL” (Hold On for Dear Life), where investors buy and hold cryptocurrencies for the long term, believing in their potential for growth. Another strategy is day trading, where investors buy and sell cryptocurrencies within a short timeframe to take advantage of price fluctuations. Swing trading involves taking positions in cryptocurrencies over a few days or weeks in response to market trends. It’s important to note that each strategy comes with its own risks and requires careful analysis and monitoring.

4. How can I manage the risks associated with cryptocurrency investments?

To manage risks associated with cryptocurrency investments, it’s important to practice proper risk management techniques. Diversify your portfolio by investing in a variety of cryptocurrencies to spread out the risk. Set a clear investment goal and stick to it, avoiding impulsive decisions driven by market fluctuations. Stay informed about market trends, news, and regulations that may impact the cryptocurrency market. Additionally, consider using tools like stop-loss orders to automatically sell your assets if they reach a certain price, limiting potential losses.

5. Is it too late to invest in cryptocurrencies?

While the cryptocurrency market has grown significantly, it is still in its early stages. As digital currencies continue to gain mainstream adoption and more industries embrace blockchain technology, there may still be ample opportunities for investment. However, it’s important to approach cryptocurrency investment with caution and do thorough research before making any investment decisions. Remember that investing in cryptocurrencies comes with risks, and past performance is not indicative of future results.

Summary

Cryptocurrency is a digital form of money that can be a risky investment. To invest wisely, it’s important to do thorough research, diversify your investments, and be aware of scams. Additionally, long-term investing is generally recommended over short-term trading. It’s crucial to stay updated on the latest news and developments in the cryptocurrency market to make informed investment decisions. Remember, investing in cryptocurrency requires patience and careful consideration to minimize risks and maximize potential returns.